(Kitco Information) – Gold and silver costs are solidly increased in early U.S. buying and selling Wednesday following a U.S. inflation report that got here in a bit cooler than anticipated. June gold hit a three-week excessive and was final up $19.10 at $2,379.00. July silver was final up $0.593 at $29.30 and hit a four-week excessive right now.

The just-released U.S. shopper worth index report for April noticed CPI up 0.3% versus the consensus forecast of up 0.4% and compares to the March report exhibiting an increase of 0.4%. The annual CPI April studying was up 3.4% and was forecast at up 3.6% and compares to up 3.8% within the March report. Merchants and buyers have been considering the CPI report may are available in sizzling right now, following the producer worth index report for April that was out Tuesday morning and ran sizzling on inflation. At present’s CPI report falls into the camp of the financial coverage doves, who wish to see the Federal Reserve lower rates of interest sooner somewhat than later. That situation is bullish for the valuable metals, from a shopper and industrial demand perspective.

Asian and European inventory indexes have been combined in a single day. U.S. inventory indexes are pointed towards firmer openings when the New York day session begins.

In in a single day information, Comex copper futures hit a brand new file excessive of $5.1280 a pound. Tighter world provides, higher world financial development, smelter points in China, in addition to rampant market hypothesis, are driving the purple industrial steel’s worth sharply increased. Might copper be the subsequent cocoa? Cocoa futures final 12 months right now have been buying and selling round $3,000 a metric ton. In April, cocoa futures reached a file excessive of $12,261 a ton.

The important thing exterior markets right now see the U.S. greenback index decrease. Nymex crude oil costs are close to regular and buying and selling round $78.00 a barrel. The yield on the benchmark 10-year U.S. Treasury notice is fetching 4.357% and down a bit after the CPI report.

Beside the CPI report, it’s a really busy day for U.S. financial knowledge Wednesday, additionally together with the weekly MBA mortgage purposes survey, the Empire State manufacturing survey, retail gross sales, actual earnings, the NAHB housing market index, manufacturing and commerce inventories, the weekly DOE liquid vitality shares report and Treasury worldwide capital knowledge. A couple of Federal Reserve officers are also slated to talk right now.

Technically, the gold futures bulls have the agency general near-term technical benefit. Bulls’ subsequent upside worth goal is to provide a detailed in June futures above strong resistance at $2,400.00. Bears’ subsequent near-term draw back worth goal is pushing futures costs under strong technical help at $2,300.00. First resistance is seen on the in a single day excessive of $2,386.40 after which at $2,400.00. First help is seen on the in a single day low of $2,360.30 after which at $2,350.00 after which at $2,330.00. Wyckoff’s Market Score: 7.5.

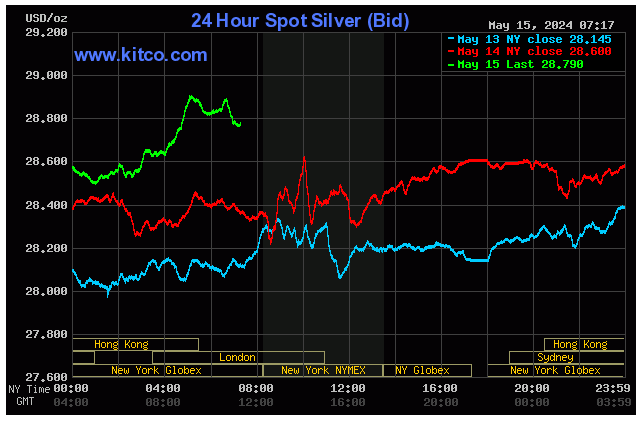

The silver bulls have the strong general near-term technical benefit and have gained good energy this week. Silver bulls’ subsequent upside worth goal is closing July futures costs above strong technical resistance at $30.00. The following draw back worth goal for the bears is closing costs under strong help at $27.50. First resistance is seen at $29.50 after which at $30.00. Subsequent help is seen at $29.00 after which on the in a single day low of $28.675. Wyckoff’s Market Score: 8.0

(Hey! My “Markets Entrance Burner” weekly electronic mail report is my greatest writing and evaluation, I feel, as a result of I get to look forward on the market and do some market worth forecasting. Plus, I’ll throw in an academic function to maneuver you up the ladder of buying and selling/investing success. And it’s free! Electronic mail me at [email protected] and I’ll add your electronic mail handle to my Entrance Burner listing.)

Disclaimer: The views expressed on this article are these of the creator and will not mirror these of Kitco Metals Inc. The creator has made each effort to make sure accuracy of data supplied; nevertheless, neither Kitco Metals Inc. nor the creator can assure such accuracy. This text is strictly for informational functions solely. It’s not a solicitation to make any trade in commodities, securities or different monetary devices. Kitco Metals Inc. and the creator of this text don’t settle for culpability for losses and/ or damages arising from the usage of this publication.