Ark Invest: Big Ideas for 2023 Ark Invest

According to ARK Invest’s research, five innovation platforms are converging to create unprecedented growth trajectories. Artificial intelligence is the catalyst that will most impact all technologies.

ARK’s 2023 research suggests that disruptive innovation platforms could have a market value of 40%, rising from $13 trillion to $200 trillion by 2030.

To enlighten investors on the long-term impact of innovation, ARK Invest began publishing Big Ideas in 2017.

This annual research report aims to highlight technological breakthroughs that are currently being made and create the potential for future super-exponential growth.

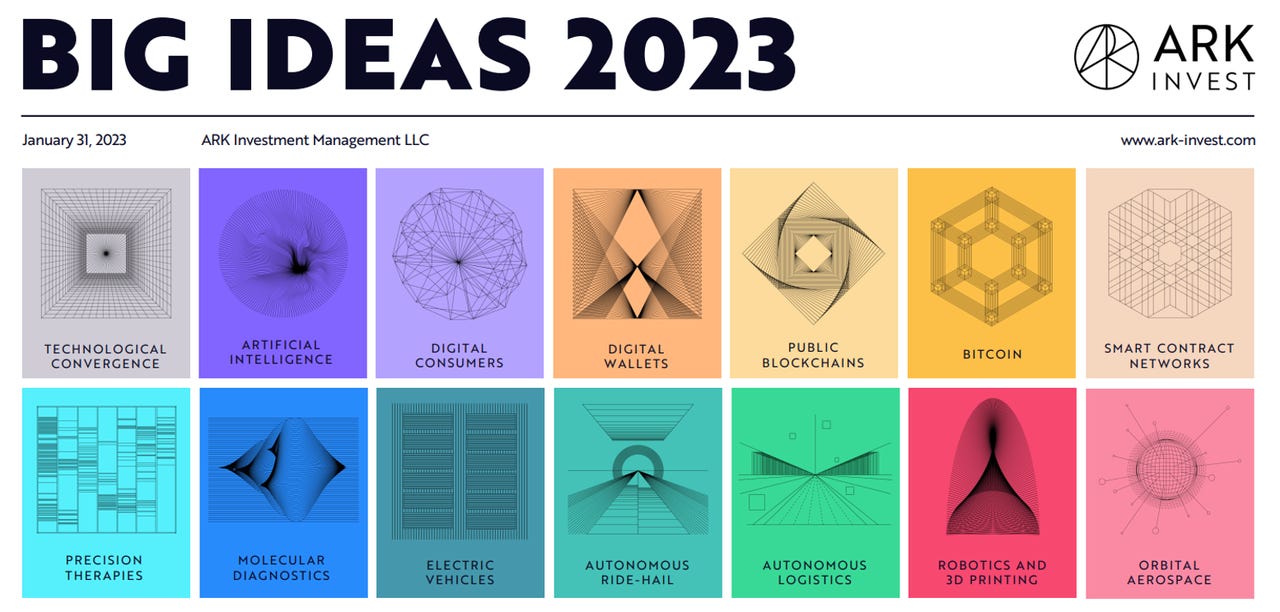

The five innovation platforms and technology catalysts cover the 14 big ideas in the 2023 report:

- Technological Convergence

- Artificial Intelligence.

- Digital consumers.

- Digital Wallets

- Public Blockchains

- Bitcoin.

- Smart Contract Networks.

- Precision Therapies

- Molecular Cancer Diagnostics.

- Electric Vehicles

- Autonomous Ride Hail

- Autonomous Logistics

- Robotics, 3D printing.

- Orbital Aerospace

In this article I will provide an overview of the first four big ideas — technical convergence, AI, digital consumer, and digital wallets.

Technology convergence

According to ARK research, five innovation platforms have converged to create unimaginable growth trajectories. These are Artificial Intelligence and Public Blockchains, Energy Storage and Robotics. Artificial Intelligence is the catalyst that has the greatest impact on all technologies, with its velocity sweeping through all others.

Also: What is ChatGPT? And why is it important?

The market value for disruptive innovation platforms could rise to 40% per year during this businesscycle, from $13 Trillion today to $200 Trillion in 2030. The global equity market capitalization could be dominated by disruptive innovation in 2030.

Autonomous Mobility exemplifies the convergence of technologies. Ark Invest

Next to digital wallets, advanced batteries systems, autonomous mobility, cryptocurrencies and intelligent devices, the most important catalysts for technology convergence are neural networks, digital wallets, advanced batteries systems, autonomous mobility, autonomous vehicles, cryptocurrencies, intelligent device, next-generation cloud, smart contracts, reusable Rockets, programmable biology. precision therapies, 3D printing. And adaptive robotics. AI chatbots will “drive” robotaxis. Deep neural network technology will make it easier to sequence long-read DNA more accurately. Robots will learn from past experiences, thanks to AI languages.

AI Language Models Advances Allow Robots To Learn From Their Experience Ark Invest

Artificial Intelligence

These are key predictions from ARK’s research on AI, with 2022 being the year for generative AI.

- This year Generative AI was a big topic, with ChatGPT and DALL-E-2 making waves. These tools improve the productivity of knowledge workers – up to 2x in the case AI coding assistants.

- The annual decline in AI training costs has continued at a rate of 70%. This means that the cost to train large language models to GPT-3 level performance fell from $4.6million in 2020 to $450,000 by 2022. ARK anticipates that cost reductions will continue at a 70% pace through 2030.

- AI should double the productivity of knowledge workers. AI could be adopted at 100% and increase global labor productivity by $200 trillion. This would dwarf the $32 trillion total salary of knowledge workers.

AI is increasing the productivity of knowledge workers. Ark Invest

ARK highlights the important point that AI can increase productivity by up to 55% in relation to writing code. AI training costs should also fall by a staggering -70% annually. Annually, AI hardware and software prices should continue to fall by 70%.

AI is driving an explosion in demand for training information. Large-scale training data is essential for the development of AI algorithms. Automating the creation of new content and data in real-time is another requirement. According to ARK’s research, the cost of training the GPT-3 state-of the-art AI model in 2020 was $4.6 Million. Based on our modeling, training an AI model that has 57x more parameters, 720x more tokens, than GPT-3, would cost $600,000 today and $600,000 in 2030.

Also: ChatGPT was able to create the WordPress plugin that I required. In less than five minutes, it did.

To put it in perspective, Wikipedia’s current 4.2 billion words represent approximately 5.6 billion tokens. It should be possible to train a model with 162 billion words (or 216 trillion tokens) by 2030. Data will be the main limitation in an age of low-cost compute. If there is enough training data, AI algorithms and automation, the potential for 10-fold increases in code productivity could be realized. The widespread adoption of advanced AI chatbots will be possible due to a decrease in costs.

AI Could Lead To A 10-Fold Rise In Coding Productivity Ark Invest

According to ARK’s research AI should improve the productivity of knowledge workers by more than fourfold by 2030. AI spending of $41 trillion at 100% adoption could increase labor productivity by $200 trillion. This would dwarf the current projections for global GDP in 2030 and rival the salaries of knowledge workers who make $32 trillion. AI software could bring in $14 trillion in revenue if vendors captured 10% of the value generated by their products. This would translate into $90 trillion in enterprise value and $14 trillion in annual revenue.

Digital Consumer

In 2022, digital leisure spending* totaled $6.6 trillion and, during the next eight years, should grow 17% at a compound annual rate to $22.5 trillion adjusted for inflation. It should be based on four trends:

- CTV: Connected TV (CTV). Approximately 85% US households have at least one CTV. But the CTV advertising market is only 23% larger than the US TV ad funds. CTV, in our opinion, is at an inflection and will be able to take share from both digital and linear TV.

- New Social Platforms: Nearly 40 percent of Gen Z users prefer TikTok and Instagram search over Google Search and Maps. The most ad dollars should be spent on social platforms that have the best recommendation engines. Content-based social media is likely to outperform follow and feed social media.

- Sports Betting: Despite macro headwinds and strong consumer demand, sports betting continues to be a popular choice. The legalization of online and mobile betting on sports should continue to stimulate growth.

- Gaming: The convergence between video games and social media should support gaming revenue growth. End-to-end virtual entertainment should be provided by video games that can compete with physical experiences

Artificial Intelligence should increase time spent on digital entertainment. Ark Invest

Global productivity gains due to generative AI could lead to an average 0.9% decrease in daily hours worked over the next five-years, from 4.7 hours per year in 2022 to 4.4% in 2030. This is a rapid decline from the previous rate of -0.4% in 2013. ARK believes consumers will be more likely to spend their time online, rather than offline, and that this will lead to a rise in online time from 39% in 2022 up to 53% for 2030.

Also: How can generative AI improve customer experience?

ARK research also predicts that short-form recommendation engines and video will take over incumbent social media. The report showed that TikTok’s engagement hours were almost equal to Facebook’s in 2022. This could signal the peak of traditional follow-and/feed social media. TikTok was able to scale faster than most social media platforms but only $10 billion or 2% of the $470 billion in social media advertising spending in 2022. Advertising share will be more likely to be captured by content-based social media if it has a higher engagement rate.

Short-Form Video and Recommendation Engines are replacing the formerly established social media. Ark Invest

The digital consumer experience will include immersive experiences, especially in gaming. ARK notes that as the gaming industry shifts to fully-service virtual worlds and video games, social media and video games could merge. This would allow consumers to socialize and entertain in virtual spaces supported by game, at the expense physical environments.

Research by ARK found that the convergence of gaming and social media will lead to a rise in gaming revenue, from 7% per year over the last five years to 10% annually over the next five. The report forecasted a substantial rise in the value of digital assets. ARK predicts that the global NFT transaction volume would grow fivefold, from $22 billion now to $120 billion in 2027.

Digital leisure and the digital consumer experience are still in their infancy. According to ARK’s research, global consumers spent 21% of their $31 trillion leisure budget on digitally-facilitated goods and services in 2022. Demand for digital goods and services is likely to grow 17% at an annual rate in real terms, surpassing demand for physically-facilitated goods and services in 2029.

Also: AI enhances customer experience and field service quality

Based on the shift toward digital leisure and digital property rights, real digital revenue* should grow 14% at an annual rate during the next eight years, from ~$2 trillion in 2022 to $5 trillion in 2030.

Digital Leisure is in Early Innings Ark Invest

Digital Wallet

Digital wallets are replacing traditional banks. Digital wallets have been adopted by billions of consumers as well as millions of merchants. They could revolutionize traditional payment transactions and save them almost $50 billion.

Digital wallets are used by 40% of the world’s population, with 3.2 billion people using them. ARK research predicts that digital wallet users will rise by 8% annually, reaching 65% in 2030.

Digital wallets are becoming more popular among merchants and consumers. As a result, traditional checking accounts as well as credit and debit cards and merchant accounts will be less frequent. This could lead to disruption in traditional payment intermediaries. Digital wallets, which eliminate middlemen, could facilitate closed-loop transactions to more than half of the payment volumes. This could potentially add $450 Billion to the $1 Trillion in digital wallet enterprise worth by 2030.

Also: How to use Apple Pay online and in-store

Both online and offline transactions are being made easier by digital wallets. In 2021, 49% of all ecommerce transactions were made by digital wallets, an increase from 18% in 2016. Digital wallets have gained share in the e-commerce market at the expense bank transfers and credit cards. Digital wallets were able to facilitate 29% of all offline transactions in 2021, almost double the 16% recorded in 2018. Digital wallets have continued to grow in popularity, surpassing cash as the primary method of offline transactions during 2020’s COVID pandemic.

Digital Wallets Gain Share in Online and Offline Transactions Ark Invest

Digital wallets scale faster than traditional accounts at financial institutions. Digital wallet adoption is driven by network effects, low customer acquisition costs, and a superior user experience. In 2022, the US saw a rebound in digital wallet adoption, surpassing all previous highs. We estimate that US digital wallet usage will increase by 7% per year over the next eight years, going from 160m to more than 265 million in 2022, and global digital wallet use will rise by 8% per annum to reach 5.6 billion (65% of the global population) by 2030.

Digital wallets are scaling faster than accounts at traditional financial institutions. Ark Invest

One of the main benefits of digital wallets, is their ability to eliminate middleman by allowing direct payments between consumers or merchants. In-network transactions allow digital wallet providers to capture higher transaction values and share the savings with consumers and merchants. Digital wallets enable merchants and consumers to create closed-loop ecosystems. Digital wallets (Alipay PayPay, Block and Kaspi) have acquired billions of users. They are now onboarding millions merchants to digital platforms that allow direct consumer-merchant transactions, which disintermediate traditional financial institutions.

Also: The top 5 payment apps

Closed loop transactions could account more than half of digital wallet payments in 2030. Closed-loop transactions are common in China and could generate close to $50 billion in cost savings for digital wallet platform, consumers and merchants. This could add $450 billion or more to the $1 trillion total enterprise value of digital wallets platforms by 2030.

Digital wallets eliminate middlemen by enabling direct payments between consumers and merchants. Ark Invest

The ARK Big Ideas 2023 Report contains amazing insights on five disruptive innovation platforms. These include 14 technology and innovation types. They could scale 40% at an annually rate of $40 trillion per year during the current business cycle.